The Phoenix will rise again: Turnaround operation in 2020 from new S Curve product with long term growth prospect.

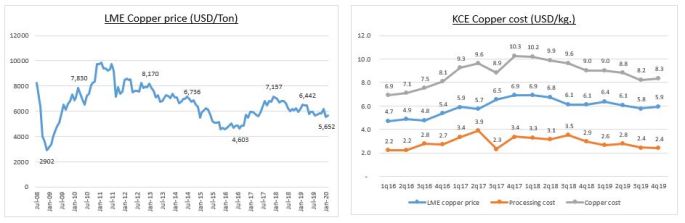

KCE (KCE:TB) core business is the production and distribution of custom Printed Circuit Boards (PCB), manufactured from copper clad laminate under the KCE trademark. KCE’s pcb products are used in a wide variety of applications including automotive, industrial, computer, and telecom systems. 70-80% of sale volume is delivered to automotive industry. The company is led by K.Pitharn Ongkosit, a young and smart CEO which has turned the company after huge flood back to be in one of the top ten Automotive PCB manufacturer in the world with market share in 2017 at 4.7%. KCE was once the greatest stock in 2012 to 2016 that delivered total return in 5 years of 2,400% or CARG at 90% p.a. (2.4 baht/share at the beginning of 2012 to reach its peak at 60 baht/share). The rising star KCE was able to deliver great return in that period because the net profit exponentially grew from 717 million baht in 2012 to 3,057 million baht mainly came from 2 factors. The first one was that after huge flood in 2011, KCE was expanding Lad KraBang Factory to meet new demand and the new factory itself was operated with the best efficiency rate prompt with better managed %waste rate at that time. And another factor was windfall from 1) heavy depreciated Thai Baht relative to USD from 30.95 to 35.12 (KCE has exported 90% of sale value) 2) Declining trend of raw material cost; main raw material to produce PCB is Copper and the LME copper price was going down from 8,000 USD/ton to 4,919 USD/ton in 2016. Whether it’s about luck or not but I believe only great management could capture and maximize opportunities.

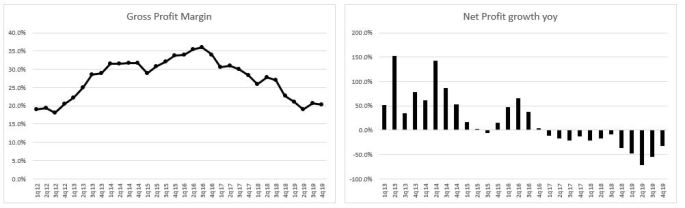

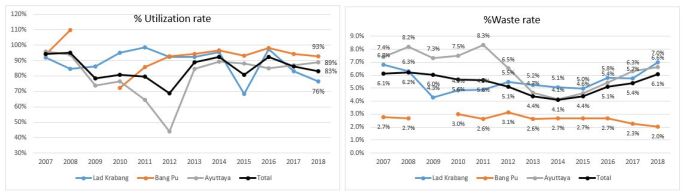

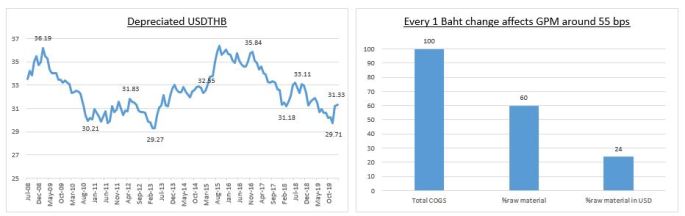

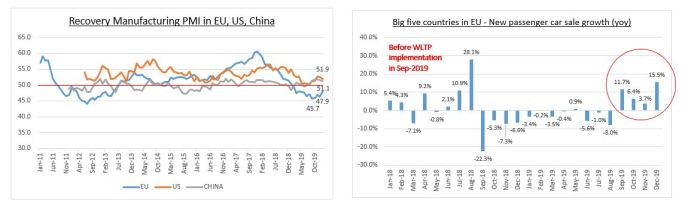

Unfortunately, happiness won’t last forever. Everything that used to be in KCE’s favor had turned upside down 1) Demand of PCB declined from regulation risk in EU. WLTP (Worldwide Harmonised Light Vehicles Test Procedure) has been implemented since Sep-2018. It is the new determining process of the levels of pollutants, CO2 emissions and fuel consumption of traditional and hybrid cars. This new regulation is changing the way they test carbon emissions which made automaker to revamp all internal testing procedure before get tested from regulator to lower their tax penalty. It slowed and hindered normal operation of automaker and also new car sale in EU so was other auto part suppliers. 2) Efficiency rate in all factories dropped mainly came from lower of utilization rate from 90% to around 70% in 2019 while some cost is fixed. In addition, KCE is now ramping up new product HDI (High Density Interconnector) higher and more sophisticated technology which initially hiked up %waste rate to 7% in 2018 vs. 5% in 2014. 3) Headwinds from economic slowdown in EU, Trade-war, Brexit, rising of copper cost, Appreciation of USDTHB from 35 to 30.78 at the end of 2019. As a result, sale was down and gross profit margin was hit harder slumped from 35% to the lowest point at 19% in 2q19. Therefore, KCE has reported negative net profit growth yoy for 12 consecutive quarters ranges from -8% to -71%. The stock price inevitably fell to 13.5 baht declined -77.5% since its peak.

However, we are interested in KCE once again because we see some external factor has turned positive and some internal efficiency improvement from great management team to lean the company. We believe KCE’s future looks brighter in 2020 and The Phoenix will rise again.

Investment ideas

- New S curve from HDI products – Radar and other Active safety system products that will be ramp up in 2020. Expects HDI sale growth at 50-70% in 2020. Currently, HDI sale accounted at 13% in 4q19 and the company expects HDI portion will reach 18%-20% by the end of 2020.

- Margin Improvement from (Expects to see gross profit margin back to 25-28%)

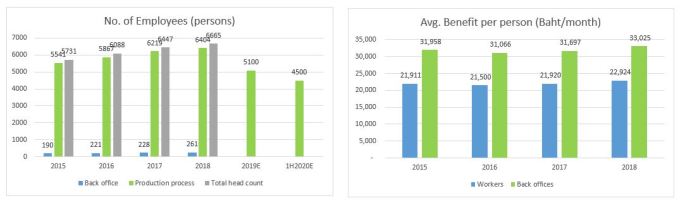

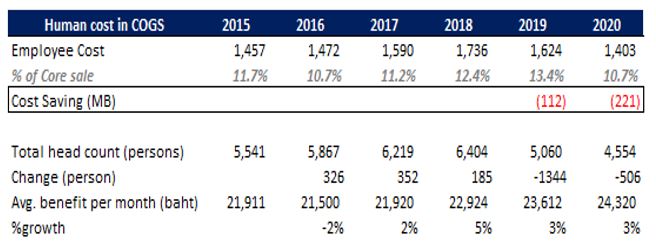

- Cost saving – Internal efficiency improvement and reducing staff from 6,665 persons 2018 to 4,500 persons in mid-2020.

- Windfall from Depreciated THB and Copper cost declined.

- Better margin from ramping up HDI product.

- Recovery of Macro factors

- Manufacturing PMI of US, EU and China have been recovered since Nov-2019

- Improvement of car sale in EU and China in Nov-Dec 2019 and expect US market to re-stock inventory.

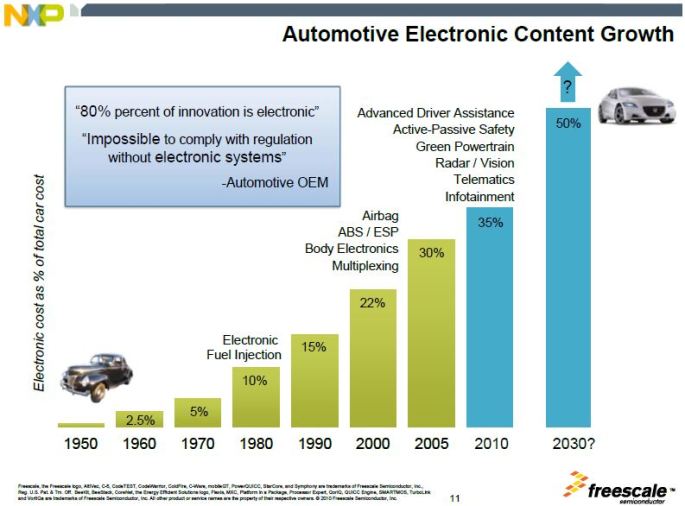

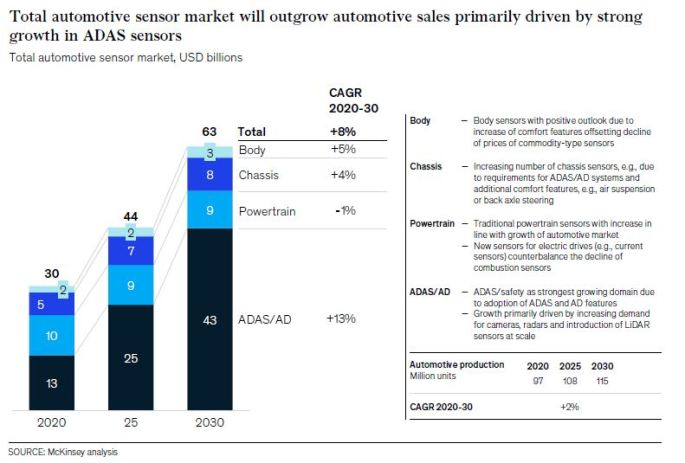

- Long term growth prospect: NXP (Freescale semiconductor) expects electronic parts cost in car will rise to 50% of total car cost in 2030 driven by 3 main themes

- ADAS (Advanced Driver Assistance Systems) and Active Safety Systems

- Electronic Vehicle adoption

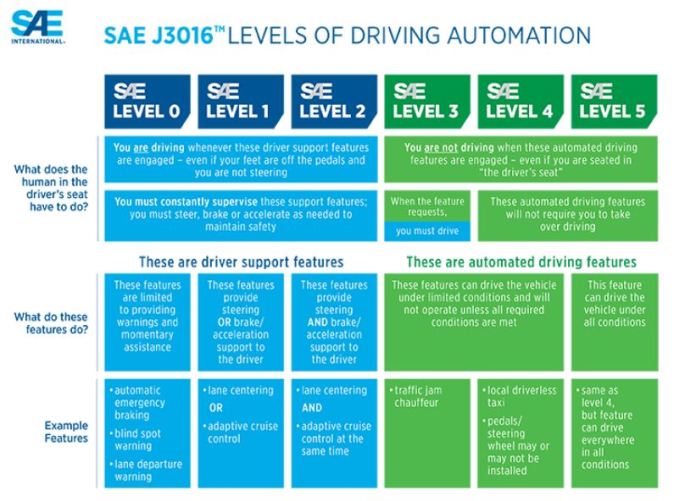

- Revolution of SAE level from Level 1-2 to Level 3-4 by 2030. (Autonomous Vehicle)

Even though, the forecast of worldwide car sale will grow at 0-2% in long term but we believe business of Electronic parts in automotive industry will outgrow actual car sale.

New S curve from HDI products

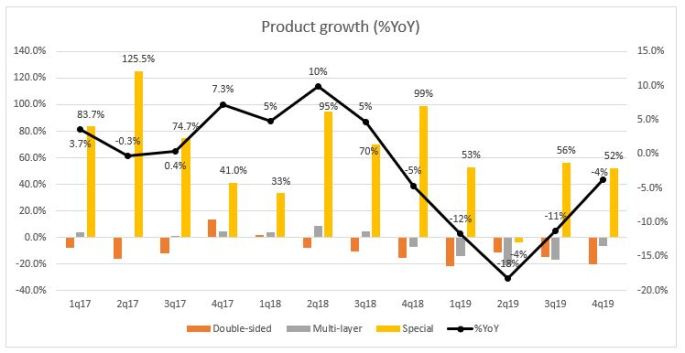

KCE has produced double-sided PCB and multilayer PCB for long time in the past but as technology of electronic manufacturing developed the market of double-sided PCB and multilayer PCB are not blue ocean anymore when Chinese and Taiwanese PCB manufacturer are becoming the biggest portion of world PCB production. China PCB production accounts around 70% of total worldwide PCB production. The higher of PCB layer, the more sophisticate it is. KCE needs to avoid price competition with Chinese manufacturers due to less economies of scale than competitors. Therefore, KCE turns themselves to new blue ocean where there is less price competition and requires higher quality and standard with sophisticated manufacturing process which is HDI product (High Density Interconnector). HDI is another level of PCB where manufacturing process needs higher precision, higher waste rate, higher sophisticated process etc. which they could demand higher of selling price for almost double compares to multilayer PCB and triple rate relatives to double sided product. Currently, KCE claims that there are only 4 major players of HDI in ADAS market (TTM – US, Bosch Tech – China, KCE – Thailand, Chin-poon – Taiwan) that could achieve required standard.

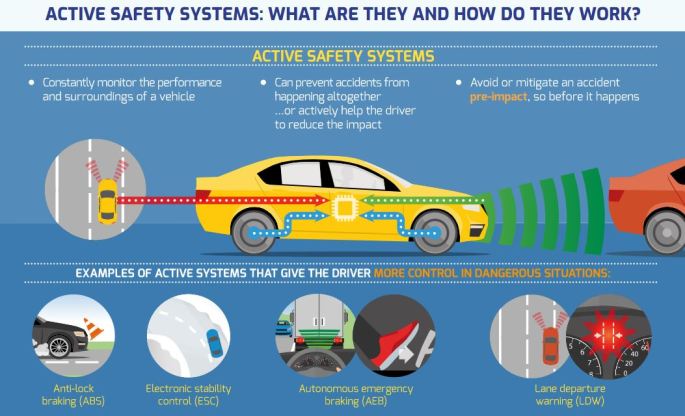

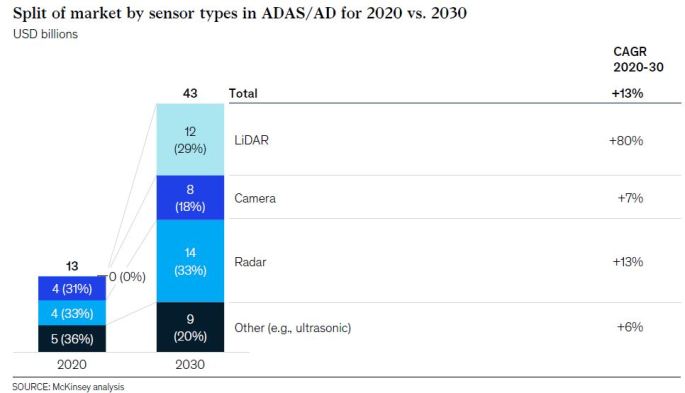

HDI product that KCE participates such as 12-Layers of Radar or short-range radar etc. This will be widely used in Active Safety System in the advanced vehicle like ADAS such as Autonomous Emergency Braking (AEB), Lane Departure Warning (LDW), Lane Keeping Assistance (LKA) or Intelligent Speed Assistance (ISA) and so on. K. Pitharn Believes active safety system is a huge market and less price competition.

In 4q19, HDI product accounted around 13% which has increased from 2% in 1q16. The company expects to ramp up new HDI product in 2020 and target HDI portion will reach nearly 20% at the end of 2020. We assume growth in HDI product at least 50% in 2020 which might be the biggest growth contribution for the whole company whilst we project other product growth at 0-2%.

Margin Improvement

Expects GPM to reach 25-28% in 2020 from 20.4% in 2019 from

- Better margin from ramping up HDI product.

As we discussed above, Avg. selling price of HDI product is higher than double-sided and multilayer PCB for 2 and 3 times, respectively. The higher of HDI sale portion in portfolio, the better of overall product margin. However, we need to monitor the scrap rate and when it actually ramp up to mass production in the future but we think the learning curve will be steep as the time pass and eventually gross profit margin will sustainably better than the past.

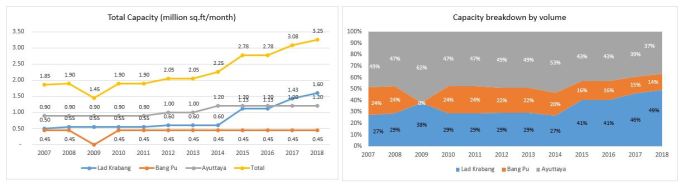

Lad Krabang factory produces HDI and Multilayer PCB while Bang Pu and Ayuttaya factory produce only double-sided and multilayer PCB. As you can see, %Waste rate significantly increased in 2016-18 where HDI product was initially produced.

- Cost saving from internal efficiency improvement and staff cutting.

Internal efficiency improvement was introduced in 2019 due to KCE was in the tough time where the management team needs to lower the cost such as Supply cost that they could save by extending machine or raw material usage life like using drilling tools more times than usual but still within proper range or change supplier to secondary tier whose quality isn’t inferior that much and etc. KCE expects to do further cost saving in 2020.

KCE cuts man power in front line from 6,665 persons 2018 to 5,100 persons in 2019 and expects to reduce to 4,500 persons in mid-2020. They confirmed that Manpower in factory will be lower in than 4,500 persons in the long-term. Workers will be replaced by robot arm which has lower cost and will breakeven in 6 months. Investment cost of robot arm is trending downward while productivity is better than human. Every 100 of worker reduction will save cost around 20-30mb per year.

- Windfall from depreciated USDTHB and lower of copper cost.

KCE has exported 90% of revenue while 24% raw material relative to COGS is imported. Therefore, every 1% change in USDTHB will impact GPM around 50-60 bps. USDTHB has depreciated for 4% YTD from 30 THB/USD at the end of 2019 to 31.2 THB/USD in Feb-2020. We assume depreciated of THB due to weak tourism of Thailand from Corona Virus 2019 and lower surplus of current account.

Main raw material to produce PCB is copper. KCE has copper cost around 20% of sale volume so every 10% change in LME copper price will affect GPM around 1-2% given stable utilization rate and currency exchange rate. KCE will purchase copper from supplier by using average LME copper price of last month as reference and it requires 1 month of shipping to factory so the effect of Copper price change will be lagged for 2-3 months.

Recovery of Macro factors (Before Corona Virus 2019 but we expect virus outbreak is temporary issue and after ending this outbreak the government must have stimulus package to spur the overall economy)

- Manufacturing PMI of US, EU and China have been recovered since Nov-2019. Improvement of car sale in EU and China in Nov-Dec 2019 and expect US market to re-stock inventory.

(KCE has sale in EU, US, China around 53%, 18% and 12%, respectively)

Long term growth prospect: NXP (Freescale semiconductor) expects electronic parts cost in car will rise to 50% of total car cost in 2030 driven by 3 main themes

- ADAS (Advanced Driver Assistance Systems) and Active Safety Systems

- Electronic Vehicle adoption

- Revolution of SAE level from Level 1-2 to Level 3-4 by 2030. (Autonomous Vehicle)

Even though, the forecast of worldwide car sale will grow at 0-2% in long term but we believe business of Electronic parts in automotive industry will outgrow actual car sale. KCE will be the beneficiary of this idea.

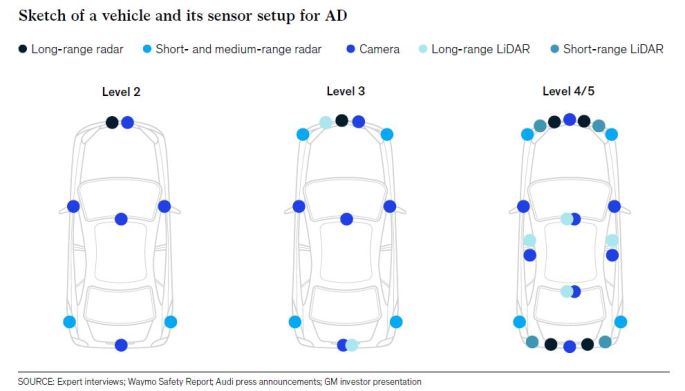

- Revolution of SAE level from Level 1-2 to Level 3-4 by 2030. (AV)

SAE Level is The Society of Automotive Engineers (SAE) determines the intelligence level and automation capabilities of Vehicles. We are now at SAE level 1-2 and the evolution of car engineering technology to reach level 3 which enable vehicle to detect environment it requires a lot of Sensor, radar, Camera, LiDAR. KCE is producing HDI that uses in these sensor and radar and expects to go mass production in 2H2020.

Level 0 = Fully manual vehicle

Level 1 = One single automated aspect of automation that assists the driver with ADAS such as braking control, Airbag, speed

Level 2 = able to control both steering and ac/deceleration ADAS capabilities. The driver remains in complete control. Self-parking.

Level 3 = able to detect environment, vehicles can make informed decision for themselves but human override is required when vehicle is unable to execute the task at hand or system fails.

Level 4 = No human interaction required – the difference is the vehicle is able to intervene themselves if things go wrong or system failures although the option to manually override does remain in preferable circumstances.

Level 5 = Human driving is completely eliminated. Vehicles do not require human attention. Level 5 is much more responsive and refined service and also excel include off-road driving. It doesn’t need steering wheel, brake pedals etc.

Risk concerns

- Global recession / Currency spread between RMB and TWD relative to THB / Raw material price.

- Economic slowdown / Supply chain disruption

- Political risk; Trade war, Brexit

- New regulation risk: China will impose CO2 emission control measures like WLTP.

- Unable to ramp up new business (HDI)